Phillips 66 is an energy manufacturing and logistics company with midstream, chemicals, refining, and marketing and specialties businesses. Co.'s segments include: Midstream, which provides crude oil and refined petroleum product transportation, terminaling and processing services, as well as natural gas and natural gas liquids transportation, storage, processing and marketing services; Chemicals, which manufactures and markets petrochemicals and plastics on a worldwide basis; Refining, which refines crude oil and other feedstocks into petroleum products; and Marketing and Specialties, which purchases for resale and markets refined petroleum products, mainly in the U.S. and Europe.

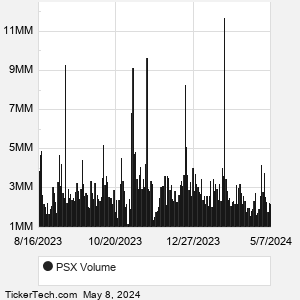

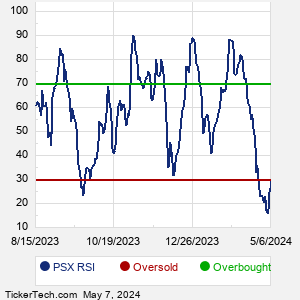

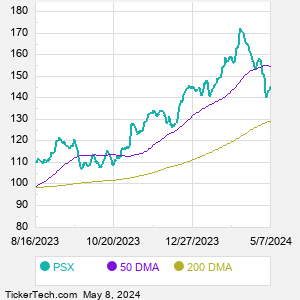

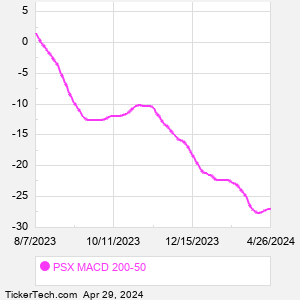

When researching a stock like Phillips 66, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from PSX Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for PSX stock — the real life supply and demand for the stock over time — and examines that data in different ways. |